TAG Financial Solutions

In my industry, one essential question always comes up: What do you do? At TAG Financial Solutions, we take a unique approach to financial services. Our mission is to help individuals uncover money they may be losing—often unknowingly and unnecessarily.

Retirement planning and financial decisions are deeply personal. You’ve worked hard to save and invest, and protecting those assets is essential. Our goal is to help you optimize your savings, ensuring financial security for both your retirement and loved ones.

As an independent financial services firm with a strong military background, we bring discipline, dedication, and a commitment to service. We specialize in helping individuals and families navigate retirement planning with customized strategies and insurance solutions. Our focus includes implementing tax-free income strategies to maximize financial security and peace of mind.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

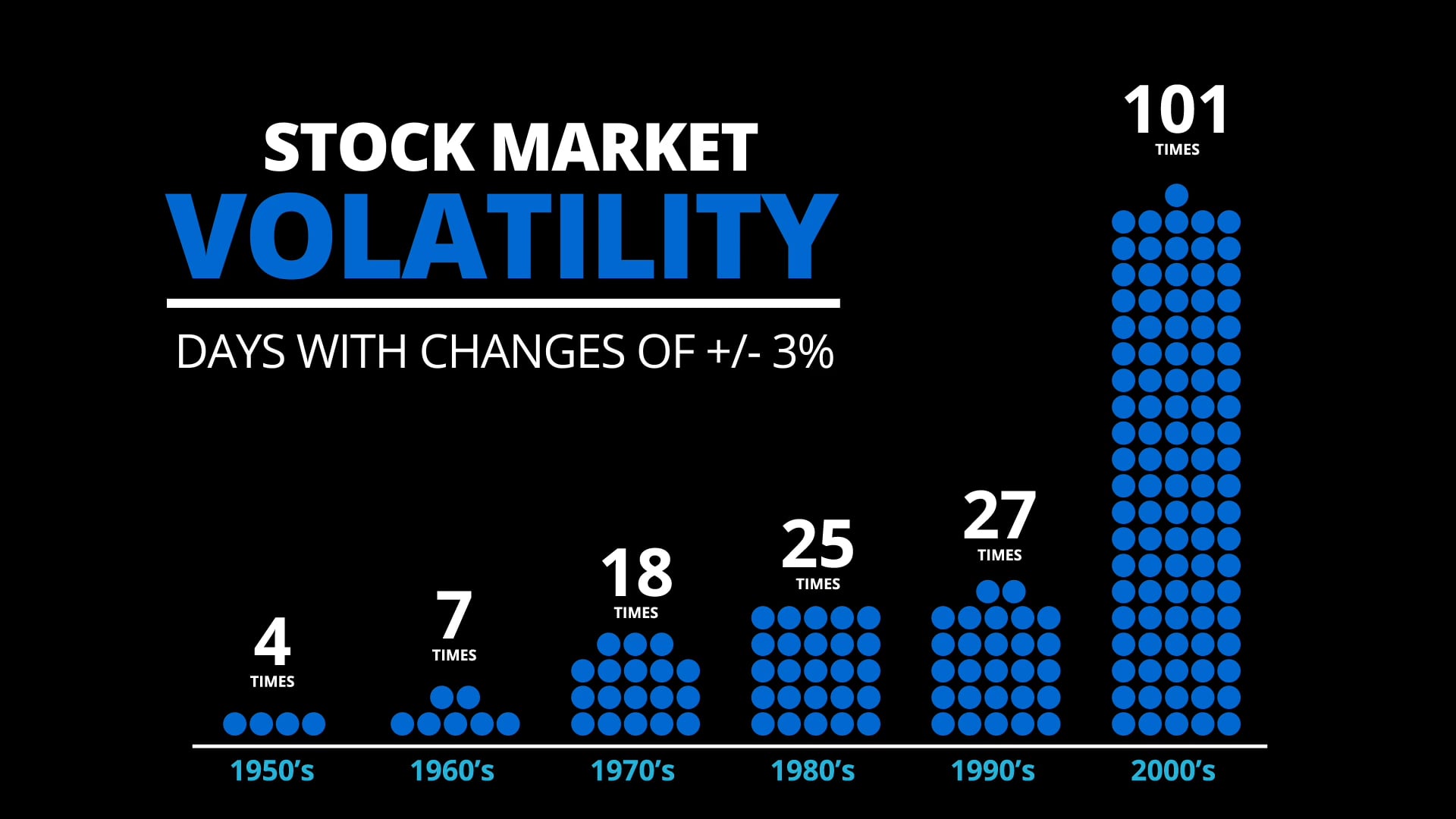

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Todd Gaswick

Founder/CEO

Through a collaborative conversation with my clients, I create a comprehensive financial plan that is designed to achieve short-, mid- and long-term financial goals via the most up-to-date products and services the financial services industry has to offer. These products and services must be in the best interests of each of my clients. I pride myself on only recommending products and services I would utilize in my own financial plan, both for myself and my family. Once a strategy is agreed upon, I offer choices of insurance, financial products and services that are appropriate for achieving the strategy and my clients’ financial goals. Together, we agree upon how often their financial situation should be reviewed. I commit to meeting with my clients as often as necessary to discuss making appropriate adjustments as time passes and goals change. Above all, I promise to serve you with respect and integrity at all times – the cornerstones of my business.

A little about myself – I grew up on a ranch in northwest Nebraska, just north of Hay Springs. Outside of managing a second ranch to the east of Hay Springs and pasture ground to the south in the Sandhills, my family raised Angus cattle and sheep. My brother and I still wrangle two ranches, the “north” ranch in his name – the “south” ranch in mine, but no longer have the Sandhills pasture.

After high school, I attended the University of Nebraska-Lincoln – yes, I’m a bonafide Cornhusker. I majored in Electrical Engineering and enrolled in the Air Force ROTC program. I graduated and was commissioned a Second Lieutenant in the Air Force in December 1984. I went on active duty in February 1985 and spent the next 20 years completing assignments that took me to Massachusetts, Montana, Washington, D.C., Hawaii and back to Nebraska serving in the acquisition, education and intelligence career fields. I retired in 2005 after a four year assignment at Offutt Air Force Base in Bellevue, NE, a suburb of Omaha. I am married, have two daughters and a couple grand critters that take up most of my spare time.

RR

Financial Planning Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Educational Events

Events in February 2026

- There are no events scheduled during these dates.

Resource Materials

Conquering Your Wealth

Conquering Your Wealth by Todd Gaswick will: give you the #1 website to track government spending; explain why you could be in a higher tax bracket when you retire; show 23 risks that can negatively affect your retirement; 11 “ideal investment strategy” requirements; a strategy that is market-risk free and tax-advantaged; 5 Case Studies featuring strategies for all stages of life.

Tips to Avoid a Market Panic Reaction

Planning for retirement is never a “set it and forget it” activity:

There are unexpected disasters, market drops, and changing laws that invariably cause retirees to reevaluate their plans. If you’re concerned about your financial security as you near and enter retirement, assessing your risk tolerance, reevaluating your portfolio, and seeking professional advice could be a good idea.

Strategies for Overcoming Six Risks to Retirement Security

A lifetime of work and diligent saving make retirement a well-earned phase of life, yet transitioning from earning to spending requires careful planning to ensure financial stability. Rather than solely focusing on a savings goal, retirees should prioritize strategies that protect and maximize retirement income. A key step in achieving this stability is understanding 6 universal retirement risks and how they could impact individual financial situations.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.