THE WEEK ON WALL STREET

Key Wall Street benchmarks were up and down last week – or rather down and then up. A Tuesday retreat was offset by a Friday rally spurred by the Department of Labor’s November jobs report.

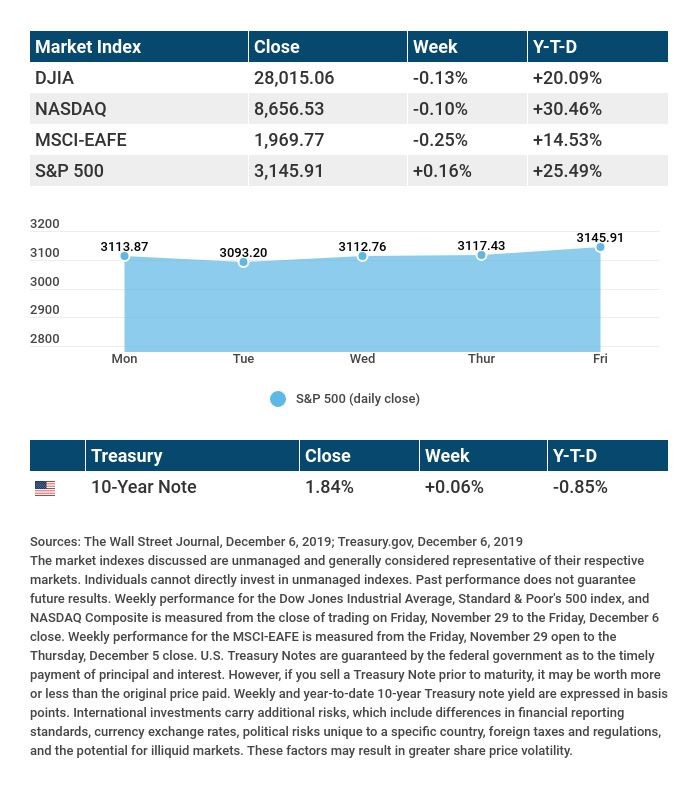

While the S&P 500 managed to rise 0.16% for the week, the Dow Jones Industrial Average declined 0.13%, and the Nasdaq Composite ceded 0.10%. MSCI’s EAFE benchmark for international stocks retreated 0.25%.1,2

Hiring Surpasses Expectations

Employers added 266,000 net new jobs last month, 79,000 more than economists surveyed by Dow Jones had projected. The main jobless rate ticked down 0.1% to 3.5%. The U-6 rate, counting both the unemployed and underemployed, also declined 0.1% to 6.9%. Wages grew 3.1% year-over-year, above the 3.0% Dow Jones estimate.

These numbers do not indicate an economy cooling off. While they were influenced by the return of striking General Motors workers to their jobs, November hiring gains were spread across several categories.3

Markets Might Wait Well Into 2020 for a China Trade Deal

The U.S.-China trade dispute has gone on for 21 months. Wall Street would like to see a new phase-one trade agreement signed this month, but the timeline could lengthen. On Tuesday, President Trump said that he was considering the option of waiting until after the 2020 election to sign off on such a pact.

On December 15, the U.S. is slated to impose a new set of tariffs on around $160 billion of Chinese products. Tech companies are eyeing this date with concern.4

FINAL THOUGHT

Holiday shopping is critical to the economy, accounting for about 20% of annual retail sales. This year’s calendar, however, does not favor retailers. The 2019 holiday shopping season is six days shorter than last year’s, as Thanksgiving fell on November 28. So, expect traders to keep close tabs on the pace of holiday spending, even with consumer confidence indices and stock benchmarks at high levels.5

TIP OF THE WEEK

Searching for a cheap airfare? Instead of just relying on results from a search engine, go a step further and check the websites of discount air carriers. Sometimes, their fares do not show up on the popular flight search sites.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The Federal Reserve makes its latest monetary policy statement, followed by a press conference featuring Fed Chairman Jerome Powell; also, the November Consumer Price Index appears.

Thursday: The Department of Commerce releases its November retail sales report.

Source: Econoday, December 6, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: AutoZone (AZO)

Wednesday: Lululemon Athletica (LULU)

Thursday: Adobe Systems (ADBE), Broadcom (AVGO), Costco (COST)

Source: Zacks.com, December 6, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“All life is an experiment. The more experiments you make, the better.”

-RALPH WALDO EMERSON

Suppose you have two twins, three triplets, and four quadruplets. How many people do you have?

LAST WEEK’S RIDDLE: I follow and lead as you pass. Dress yourself in black, my darkness lasts. I flee the light, but without the sun, your view of me would be gone. Now tell me, what am I?

ANSWER: Your shadow.

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – wsj.com/market-data [12/6/19]

2 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [12/6/19]

3 – cnbc.com/2019/12/06/us-nonfarm-payrolls-november-2019.html [12/6/19]

4 – washingtonpost.com/us-policy/2019/12/03/trump-says-trade-deal-with-china-could-wait-until-after-election/ [12/3/19]

5 – bit.ly/38ejx8o [11/26/19]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [12/6/19]

quotes.wsj.com/index/SPX/historical-prices [12/6/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2019 [12/6/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [12/6/19]