THE WEEK ON WALL STREET

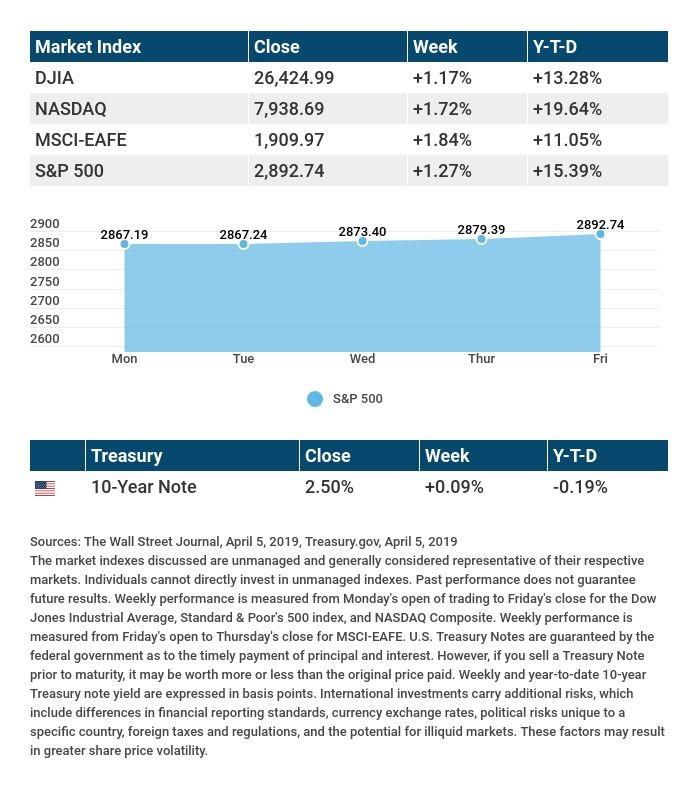

Stocks posted their second straight weekly gain. The Dow Jones Industrial Average gained 1.17% in five trading days; the S&P 500, 1.27%; the Nasdaq Composite, 1.72%. The MSCI EAFE index of international stocks rose 1.84%.1-4

Investors got some good news last week: an encouraging employment report and indications that a new U.S.-China trade deal might be near.

A SOLID HIRING REPORT

The economy generated 196,000 net new jobs in March, according to the Department of Labor. Monthly job growth averaged 180,000 in the first quarter.

The March hiring recovery eased Wall Street concerns about a near-term economic downturn. If payroll growth is this strong in April and May, the Federal Reserve may be motivated to rethink its pause of interest rate hikes.5

ANOTHER STEP IN THE TRADE TALKS

Chinese Vice Premier Liu He said last week that the U.S. and China have come to a consensus on the basics of a new trade accord. President Trump commented Thursday that “the next four weeks” of negotiations will be critical.6

WHAT’S NEXT

The first-quarter earnings season kicks off this week with three of the biggest banks in the country reporting results. The question is whether stocks in the S&P 500 will post earnings that beat analyst expectations to the degree that they have in the past few quarters.

TIP OF THE WEEK

A new business owner should have some cash available for professional services, such as legal or accounting help. Those services will probably be necessary before the business receives any funding.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Minutes from the March Federal Reserve meeting, plus the latest Consumer Price Index, tracking monthly and yearly inflation.

Friday: The initial University of Michigan consumer sentiment index for April, which assesses consumer confidence.

Source: Econoday / MarketWatch Calendar, April 5, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Bed Bath & Beyond (BBBY), Delta Air Lines (DAL)

Thursday: Fastenal (FAST), Rite Aid (RAD)

Friday: JPMorgan Chase (JPM), PNC (PNC), Wells Fargo (WFC)

Source: Morningstar.com, April 5, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

1 – quotes.wsj.com/index/SPX [4/5/19]

2 – quotes.wsj.com/index/DJIA [4/5/19]

3 – quotes.wsj.com/index/COMP [4/5/19]

4 – quotes.wsj.com/index/XX/990300/historical-prices [4/5/19]

5 – cnn.com/2019/04/05/economy/march-jobs-report/index.html [4/5/19]

6 – cnbc.com/2019/04/05/stock-market-us-china-trade-nonfarm-payrolls-in-focus.html [4/5/19]

markets.wsj.com [4/5/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2019 [4/5/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [4/5/19]