THE WEEK ON WALL STREET

U.S. stock indices saw significant ups and downs last week, with traders looking for economic cues from Treasury yields and also developments in the tariff fight between the U.S. and China.

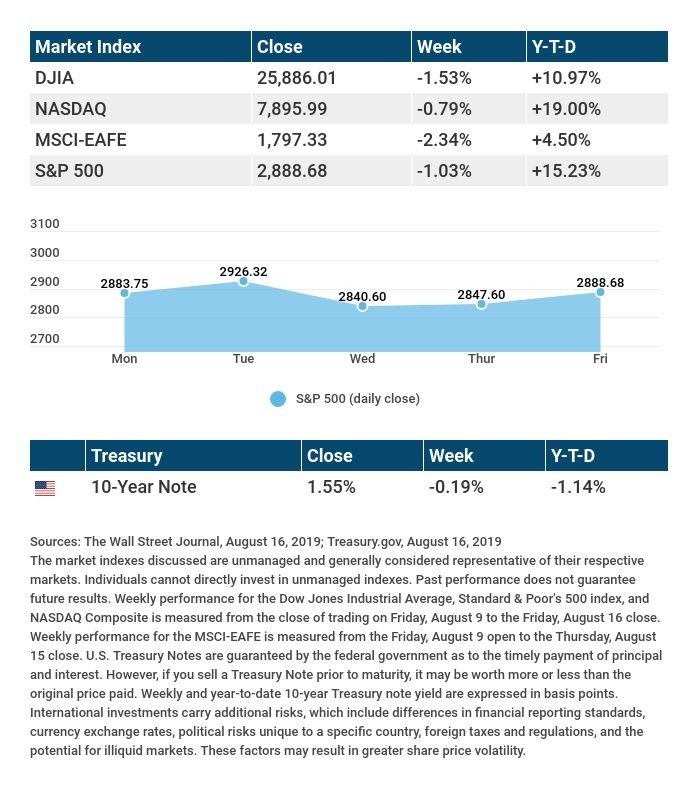

The S&P 500 lost 1.03% on the week; the Dow Jones Industrial Average and Nasdaq Composite respectively declined 1.53% and 0.79%. Overseas shares also retreated: the MSCI EAFE index lost 2.34%.1,2

Attention on the Bond Market

Wednesday, the yield of the 2-year Treasury bond briefly exceeded that of the 10-year Treasury bond. When this circumstance occurs, it signals that institutional investors are less confident about the near-term economy. That view is not uniform. Asked whether the U.S. was on the verge of an economic slowdown, former Federal Reserve Chair Janet Yellen told Fox Business “the answer is most likely no,” noting that the economy “has enough strength” to avoid one.

The demand for bonds has definitely pushed prices for 10-year and 30-year Treasuries higher, and their yields are now lower (bond yields usually fall as bond prices rise). The 30-year Treasury yield hit a historic low last week.3,4

Some China Tariffs Postponed

Last week, the Office of the U.S. Trade Representative announced that about half the Chinese imports slated to be taxed with 10% tariffs starting September 1 would be exempt from such taxes until December 15.

The White House said that the reprieve was made with the upcoming holiday shopping season in mind, so that tariffs might have less impact on both retailers and consumers.5

FINAL THOUGHT

Lower interest rates on bonds are now influencing mortgages. According to mortgage reseller Freddie Mac, the average interest rate on a conventional 30-year home loan was just 3.6% last week. That compares to 3.81% roughly a month ago (July 18).6

30-year and 15-year fixed rate mortgages are conventional home loans generally featuring a limit of $484,350 ($726,525 in high-cost areas) that meet the lending requirements of Fannie Mae and Freddie Mac, but they are not mortgages guaranteed or insured by any government agency. Private mortgage insurance, or PMI, is required for any conventional loan with less than a 20% down payment.

TIP OF THE WEEK

If you do any freelance work, keep your freelance budget spending separate from your personal budget spending, for clarity at tax time and for a clearer view of your business expenses.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The minutes of the July Federal Reserve meeting and the latest existing home sales data from the National Association of Realtors.

Friday: Federal Reserve Chairman Jerome Powell delivers a speech at the Fed’s annual Jackson Hole economic conference on monetary policy, and July new home sales numbers arrive from the Census Bureau.

Source: Econoday / MarketWatch Calendar, August 16, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Baidu (BIDU), Estee Lauder (EL)

Tuesday: Home Depot (HD), Medtronic (MDT), TJX Companies (TJX)

Wednesday: Analog Devices (ADI), Lowe’s (LOW), Target (TGT)

Thursday: Salesforce (CRM), Intuit (INTU)

Source: Zacks, August 16, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Human felicity is produced not so much by great pieces of good fortune that seldom happen, as by little advantages that occur every day.”

– BEN FRANKLIN

Without fingers, I point; without arms, I strike; without feet, I run. What am I?

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – wsj.com/market-data [8/16/19]

2 – quotes.wsj.com/index/XX/990300/historical-prices [8/16/19]

3 – cnbc.com/2019/08/15/us-bonds-30-year-treasury-yield-falls-below-2percent-for-first-time-ever.html [8/15/19]

4 – foxbusiness.com/economy/janet-yellen-to-wall-street-a-recession-is-unlikely [8/14/19]

5 – reuters.com/article/us-usa-trade-china-tariffs/trump-delays-tariffs-on-chinese-cellphones-laptops-toys-markets-jump-idUSKCN1V31CX [8/13/19]

6 – freddiemac.com/pmms/archive.html [8/16/19]

wsj.com/market-data [8/16/19]

quotes.wsj.com/index/SPX/historical-prices [8/16/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [8/16/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [8/16/19]