THE WEEK ON WALL STREET

Last week, investors assessed earnings and the initial estimate of second-quarter economic growth, while awaiting the Federal Reserve’s next announcement about interest rates.

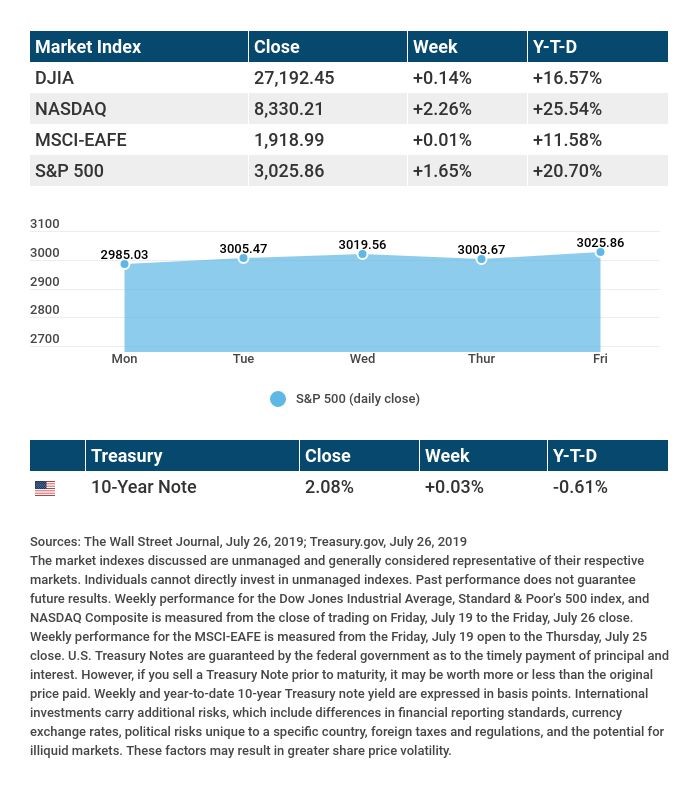

Stocks rose for the week; particularly, tech shares. The S&P 500 gained 1.65%; the Nasdaq Composite, 2.26%. The Dow Jones Industrial Average lagged, adding just 0.14%. MSCI’s EAFE index, a gauge of equity performance in developed foreign markets, ticked up 0.01%.,1,2

Economy Grew Moderately in Q2

Analysts surveyed by Dow Jones Newswires had forecast 2.0% GDP for the second quarter. The actual estimate, announced Friday by the Bureau of Economic Analysis, was slightly better at 2.1%.3

While this is the poorest quarterly GDP number since the opening quarter of 2017, the decline in GDP largely reflects a decrease in business investment. Consumer spending improved 4.3% in Q2, and government spending rose 5.0%, which was the biggest quarterly gain in a decade.3

China Trade Talks to Restart

U.S. trade delegates are scheduled to resume face-to-face negotiations with their Chinese counterparts, starting Tuesday in Shanghai.

This renewed effort to forge a bilateral trade pact could go on for some time. Secretary of the Treasury Steven Mnuchin, who is part of the U.S. delegation, told reporters last week that it would likely take “a few more meetings” before any kind of accord can be considered.4

WHAT’s NEXT

Wednesday at about 2:00pm EST, the Federal Reserve is scheduled to conclude its July meeting. Wall Street is eager to see what the Fed will do with interest rates. The question is whether traders have priced in expectations of a cut and how they may react if no cut comes.

TIP OF THE WEEK

When it comes to insuring your residence, remember that the right amount of coverage is based on what it costs you to replace your home, not just to reconstruct it. Some homeowners underinsure their homes and end up paying some rebuilding or repair costs out of pocket after a calamity.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The federal government’s June personal spending report and the Conference Board’s monthly index of consumer confidence.

Wednesday: The Federal Reserve presents its latest statement on interest rates and monetary policy, and payroll titan ADP offers its July private-sector employment snapshot.

Thursday: The latest report on American manufacturing from the Institute for Supply Management.

Friday: July jobs data from the Department of Labor and the University of Michigan’s final July Consumer Sentiment Index, measuring household confidence in the economy.

Source: Econoday / MarketWatch Calendar, July 26, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: RingCentral (RNG)

Tuesday: Apple (APPL), Mastercard (MA), Merck (MRK), Pfizer (PFE), Procter & Gamble (PG)

Wednesday: General Electric (GE), Qualcomm (QCOM)

Thursday: Royal Dutch Shell (RDS.A), Verizon (VZ)

Friday: Berkshire Hathaway (BRK.B), Chevron (CVX), ExxonMobil (XOM), Toyota (TM)

Source: Zacks, July 26, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

1 – wsj.com/market-data [7/26/19]

2 – quotes.wsj.com/index/XX/990300/historical-prices [7/26/19]

3 – cnbc.com/2019/07/26/us-gdp-second-quarter-2019.html [7/26/19]

4 – reuters.com/article/us-usa-trade-china/top-us-china-trade-negotiators-to-meet-in-shanghai-next-week-idUSKCN1UJ1JI [7/24/19]

wsj.com/market-data [7/26/19]

quotes.wsj.com/index/SPX/historical-prices [7/26/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [7/26/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [7/26/19]