THE WEEK ON WALL STREET

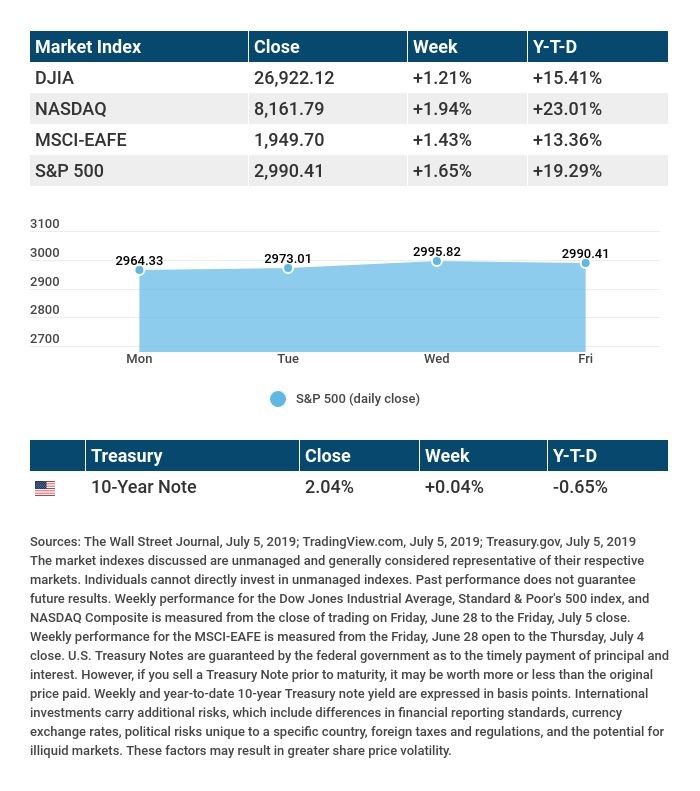

U.S. stock benchmarks opened a new quarter positively. The S&P 500 gained 1.65% in the opening week of July; the Dow Jones Industrial Average, 1.21%; the Nasdaq Composite, 1.94%. Overseas, stocks in developed markets, tracked by MSCI’s EAFE index, rose 1.43%.1-4

On July 3, the S&P posted its latest record close: 2,995.82. On July 5, stocks fell, slightly, after the Department of Labor released its June employment report.5

Jobs Report Beats Expectations

Analysts polled by Bloomberg thought the economy would add 160,000 net new jobs in June. Instead, the number was 224,000. The headline unemployment rate ticked up 0.1% to 3.7%; the U-6 rate, including the underemployed, also rose 0.1% to 7.2%.6

Before the large June gain was announced, traders were confident that the Federal Reserve would adjust interest rates this summer. This latest hiring data called that confidence into question.

More Tariffs Slated for European Goods

The federal government plans to levy new import taxes on $4 billion of food and beverages coming from the European Union, the Office of the U.S. Trade Representative said last week. This would complement the tariffs on $21 billion worth of E.U. imports announced in April.7

The U.S. and E.U. generate more than $1 trillion in commerce through trade relationships. European exports to the U.S., however, far outweigh U.S. exports to the E.U.7

WHAT’s AHEAD

Monday, July 15 will mark the start of the next earnings season. Money-center banks report first, followed by companies from a variety of industries.

TIP OF THE WEEK

A good, small-business invoice ideally states five things: the timeframe the company gives the client to pay, whether the client is permitted to pay upfront, whether late fees can be charged, the kinds of payments accepted, and if delivery will occur before or after receipt of payment.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Federal Reserve Chairman Jerome Powell delivers opening remarks at a conference of the Federal Reserve Bank of Boston.

Wednesday: Fed Chair Powell testifies on monetary policy in Congress, and the Fed also releases the minutes from its June meeting.

Thursday: The June Consumer Price Index appears, showing monthly and yearly changes in inflation.

Source: Econoday / MarketWatch Calendar, July 5, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: PepsiCo (PEP)

Wednesday: Bed Bath & Beyond (BBBY)

Thursday: Delta Air Lines (DAL), Fastenal (FAST)

Source: Zacks.com, July 5, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

1 – quotes.wsj.com/index/SPX/historical-prices [7/5/19]

2 – quotes.wsj.com/index/DJIA/historical-prices [7/5/19]

3 – quotes.wsj.com/index/COMP/historical-prices [7/5/19]

4 – quotes.wsj.com/index/XX/990300/historical-prices [7/5/19]

5 – marketwatch.com/story/sp-500-heads-for-3rd-straight-record-ahead-of-private-sector-jobs-report-2019-07-03 [7/3/19]

6 – fortune.com/2019/07/05/us-hiring-jobs-data-rebounds/ [7/5/19]\

7 – cnn.com/2019/07/02/economy/us-tariffs-on-eu/index.html [7/2/19]

quotes.wsj.com/index/SPX/historical-prices [7/5/19]

quotes.wsj.com/index/DJIA/historical-prices [7/5/19]

quotes.wsj.com/index/COMP/historical-prices [7/5/19]

tradingview.com/markets/indices/quotes-us/ [7/5/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2019 [7/5/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [7/5/19]