THE WEEK ON WALL STREET

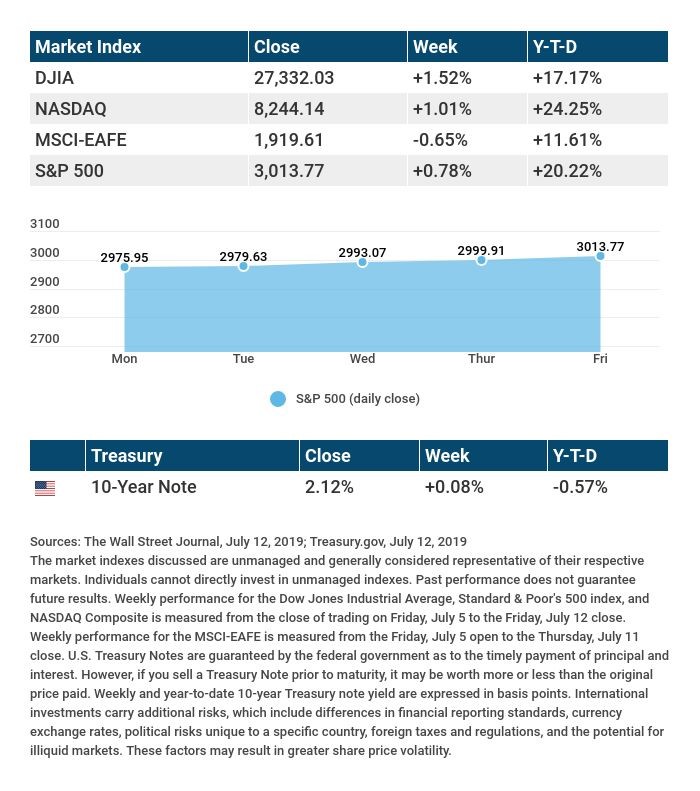

Friday, the S&P 500 settled above 3,000 for the first time, after rising 0.78% for the week. The Dow Jones Industrial Average chalked up a milestone of its own: the blue chips ended the week above 27,000, gaining 1.52% on the way. Additionally, the Nasdaq Composite wrapped up the week 1.01% higher. The MSCI EAFE index, a gauge of overseas developed markets, fell 0.65%.1-3

Stocks rallied at mid-week with help from Federal Reserve Chairman Jerome Powell’s congressional testimony on monetary policy, plus the latest Fed meeting minutes.

Jerome Powell’s Statements

Wednesday, Chairman Powell told Capitol Hill lawmakers that “uncertainties around global growth and trade continue to weigh on the outlook” of the Federal Open Market Committee. He also noted that “manufacturing, trade, and investment are weak all around the world.”4

On the same day, the Fed presented the minutes of its June policy meeting. The record shared the belief of some Fed officials that “a near-term cut in the target range for the federal funds rate could help cushion the effects of possible future adverse shocks to the economy.”4

Overall Inflation Remains Muted

The June Consumer Price Index, released last week by the Bureau of Labor Statistics, measured only 1.6% yearly inflation. The Federal Reserve uses the Bureau of Economic Analysis’ Core Personal Consumption Expenditures (PCE) Price Index as its inflation barometer; in its latest edition, it showed just a 1.5% year-over-year rise.5

Currently, the Fed has a yearly inflation target of 2.0%. In the past, it has often raised interest rates in response to increasing inflation, which can potentially slow growth and affect hiring and employment levels. Absent significant inflation pressure, such a response may not be forthcoming.5

FINAL THOUGHT

All eyes are on corporate earnings this week, as prominent banks and about two dozen other S&P 500 firms report second-quarter results. Market participants have much to consider in terms of profits, revenue, and guidance.

TIP OF THE WEEK

Done wrong, a do-it-yourself estate strategy can lead to some tax management issues for your heirs. Other common problems include using documents inappropriate for your state or a power of attorney that your bank may challenge.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Fed chair Jerome Powell delivers a speech on monetary policy at the G7 summit in France, and the Census Bureau releases its June retail sales report.

Friday: The University of Michigan presents its preliminary July consumer sentiment index, measuring consumer confidence and perceptions of the economy.

Source: Econoday / MarketWatch Calendar, July 12, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Citigroup (C), J.B. Hunt (JBHT)

Tuesday: Goldman Sachs (GS), Johnson & Johnson (JNJ), JPMorgan Chase (JPM), Wells Fargo (WFC)

Wednesday: Bank of America (BAC), Netflix (NFLX), Novartis (NVS), Abbott Labs (ABT)

Thursday: Microsoft (MSFT), UnitedHealth (UNH)

Friday: American Express (AXP)

Source: Zacks, July 12, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

1 – cnbc.com/2019/07/12/stock-market-dow-futures-rise-after-fed-hints-at-rate-cut-ahead.html [7/12/19]

2 – wsj.com/market-data [7/12/19]

3 – quotes.wsj.com/index/XX/990300/historical-prices [7/12/19]

4 – investopedia.com/markets-cheer-lower-interest-rate-outlook-4692639 [7/10/19]

5 – reuters.com/article/us-usa-economy-inflation/u-s-core-cpi-posts-biggest-gain-in-nearly-1-1-2-years-idUSKCN1U61NR?il=0 [7/11/19]

wsj.com/market-data [7/12/19]

quotes.wsj.com/index/SPX/historical-prices [7/12/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [7/12/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [7/12/19]